life insurance face amount and death benefit

A permanent life insurance policys face amount can decrease or increase due to several different circumstances. The death benefit amount depends on the policy the insured chose when they applied for life insurance.

Types Of Policies And Riders Chapter 3 Diagram Quizlet

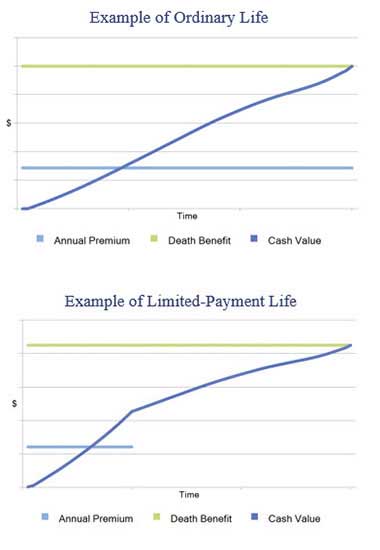

At the beginning of the policy the face value and the death benefit are the same.

. The face value of life insurance is the dollar amount equated to the worth of your policy. It can also be referred to as the death benefit or the face amount of life insurance. Typically the contracts face amount or face value is the death benefit your recipients will collect however there a few cases in which the death benefit does not equal the.

When an insured individual dies the insurance will pay the beneficiary or beneficiaries the amount of the death benefit that was acquired. The face amount and thereby the death benefit. So if you buy a policy with a 500000 face value in most cases your life insurance company will pay out 500000 to your beneficiaries when you die.

The face value is the sum of. For most whole life insurance policies when you pay your. The face amount is the initial amount of money which is stated on the face of the contract that will be paid in a death claim.

Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. Choosing the right life. Death benefit insurance for seniors receiving life.

They both reflect the amount of money that the insurance company will pay out in the case of a. So if you have a policy with a face value or death benefit of 200000 and an outstanding loan of 50000 your beneficiaries would be paid roughly 150000 upon your death. Beneficiaries will receive the total contracted amount.

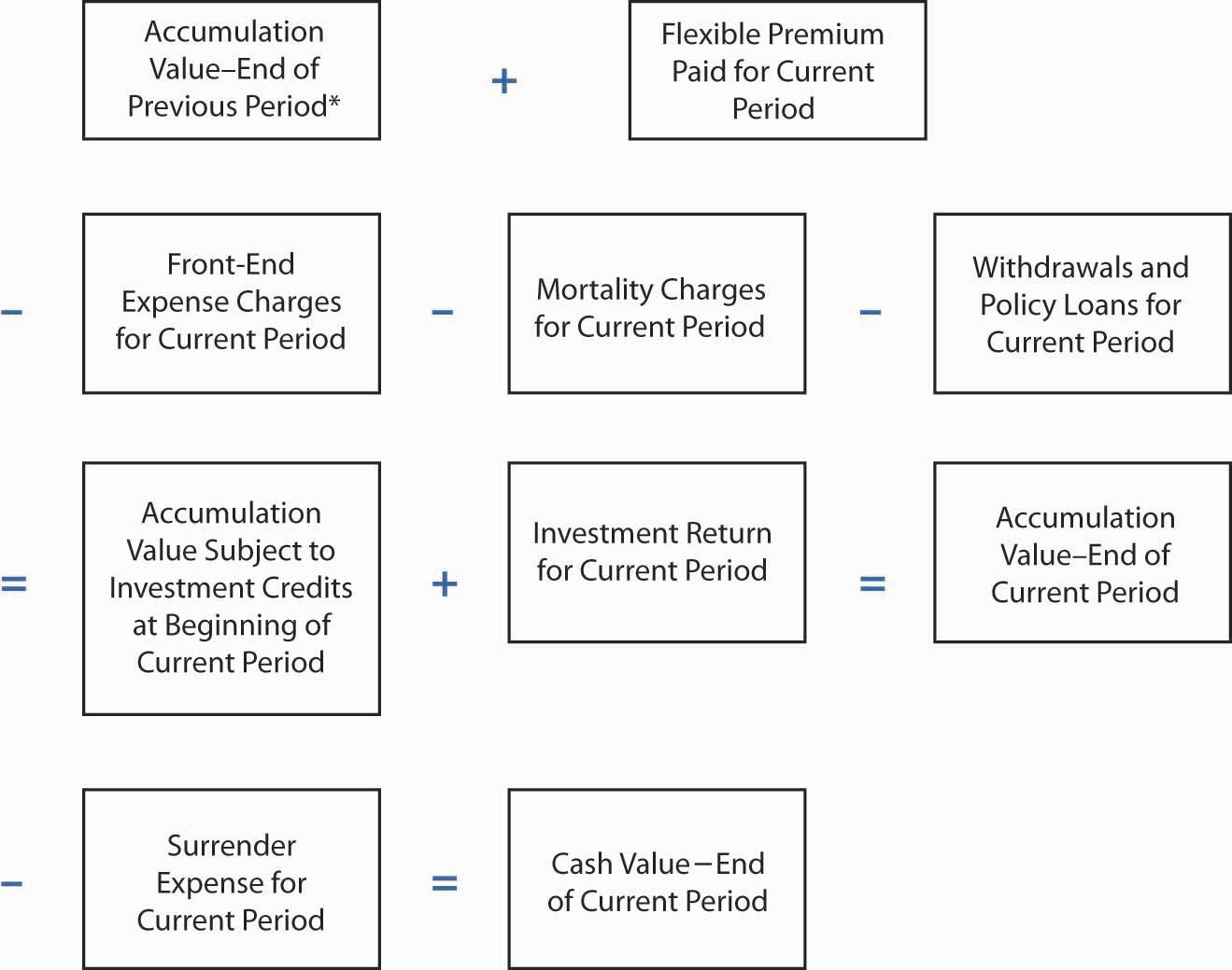

The death benefit of a life insurance policy represents the face amount that will be paid out on a tax-free basis to the policy beneficiary when the insured person dies. Conversely if the policy is universal life insurance with an increasing death benefit upon the death of the insured the beneficiary receives 500000 of insurance plus any. The death benefit amount is based on the face value of the life insurance policy with subtractions for any withdrawals you made from cash value or policy loans you didnt pay.

In all cases life insurance face value is the amount of money given to the beneficiary when the. For example the policyholder can decide to pay an additional. So the face value of a 10000 policy is 10000.

This is usually the same amount as the death benefit. The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your heirs. Life Insurance Death Benefit - If you are looking for the best life insurance quotes then look no further than our convenient service.

It can also be referred to as the death benefit or the face amount of life insurance.

2022 Final Expense Insurance Guide Costs For Seniors

Mortality Risk Management Individual Life Insurance And Group Life Insurance

Life Insurance Education Catholic Financial Life

Types Of Life Insurance Don Boozer Associates Inc 800 543 0886

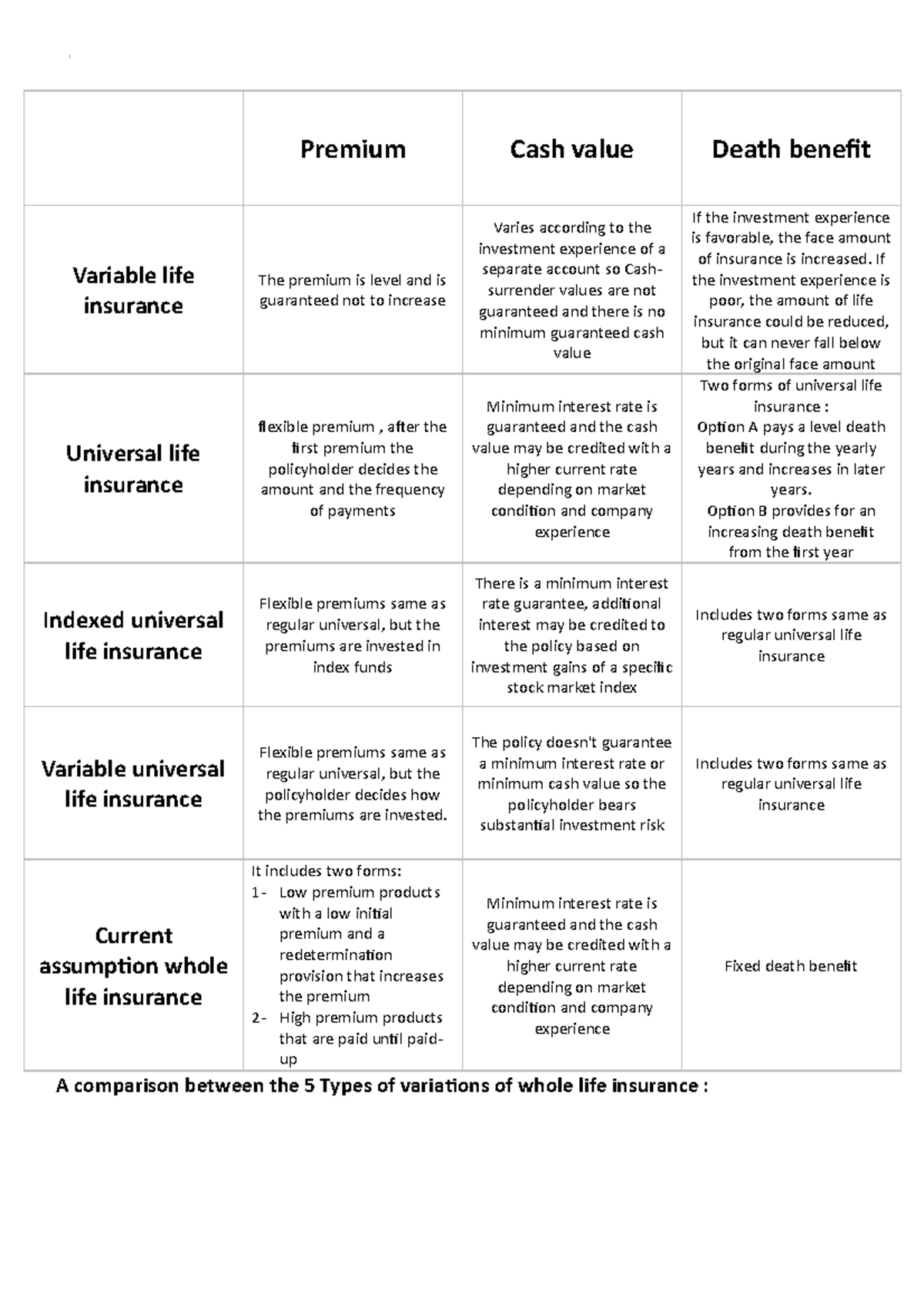

Variations Variation Of Life Insurance Policies Premium Cash Value Death Benefit Variable Life Studocu

What Are Life Insurance Riders Aig Direct Blog

Should I Cancel My Whole Life Insurance Policy White Coat Investor

What Is Whole Life Insurance Wealth Nation

Too Expensive It S More Costly Not To Have Life Insurance Llis

How Does A Whole Life Insurance Policy Work Rusnewstoday24

Glossary Of Life Insurance Terms Smartasset Com

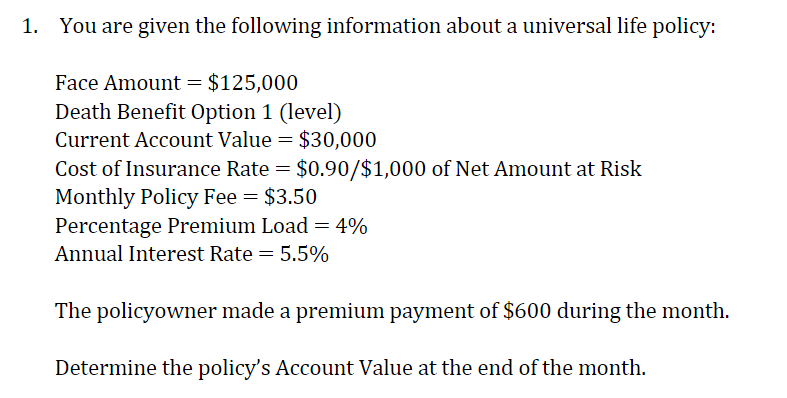

1 You Are Given The Following Information About A Chegg Com

Learn The Basics Types Of Life Insurance Policies

Minimum And Maximum Over Funded Life Insurance Policies Innovative Retirement Strategies Inc

How Can Whole Life Insurance Premiums Remain Level Bank On Yourself